Unveiling the Strategy of Target Pricing

A Guiding Light for Startup Success

Introduction:

In the ever-evolving landscape of business, where startups strive for innovation and market relevance, pricing strategies emerge as a critical factor in determining success. Among these strategies, target pricing stands out as a method that not only aligns with customer expectations but also serves as a potential solution for startups to gauge the viability of their Minimum Viable Product (MVP) right from the beginning.

In this blog post, we will delve into the intricacies of target pricing, exploring its benefits, potential drawbacks, the step-by-step process to implement it, and providing a real-world example.

Join us on this journey to unravel the strategic prowess of target pricing and how it can be a game-changer for startups aiming to not only survive but thrive in the competitive business landscape.

What is Target Pricing?

Target pricing is a dynamic pricing strategy that revolves around setting a product’s price based on a predefined profit margin. This customer-centric approach takes into account market conditions and competitive pricing, making it a crucial strategy for startup success.

Why a Good Way for Startups?

For startups, the journey begins with the development and introduction of their MVP. Target pricing proves to be an invaluable tool in this phase, enabling startups to align their product pricing with customer expectations right from the outset. By gauging market dynamics and competitor pricing during this early stage, startups can ensure that their MVP is not only innovative but also priced competitively.

Benefits of Target Pricing:

- Foolproof Solution for Startups: Target pricing provides startups with a reliable and structured approach to setting prices. By aligning with customer value expectations and considering market dynamics, it serves as a strategic guide, increasing the likelihood of success in the challenging early stages of a business. The emphasis on customer satisfaction and competitive positioning helps startups carve out a niche and establish themselves in the market.

- Customer-Centric Approach: Target pricing ensures that the final product price resonates with customers, promoting customer loyalty and satisfaction.

- Competitive Edge: By considering market conditions and competitors’ pricing, target pricing helps businesses stay competitive and can potentially capture market share faster.

- Profitability Control: Setting a predefined profit margin allows businesses to maintain control over their profitability goals, ensuring sustainable business growth.

Cons of Target Pricing:

- Complexity: Determining the right target price involves analyzing various market factors, making it a more complex process than traditional pricing methods.

- Market Uncertainty: Rapid changes in market conditions can make it challenging to accurately predict customer expectations, changes in customers perceived value, and ultimately set an optimal target price.

- Neglecting Production Costs: Overemphasis on customer preferences and market conditions might lead to overlooking production costs, risking profitability.

Steps to Perform Target Pricing:

- Market Analysis: Understand the market conditions, customer preferences, and competitors’ pricing strategies.

- Determine Desired Profit Margin: Set a realistic profit margin that aligns with the company’s financial goals.

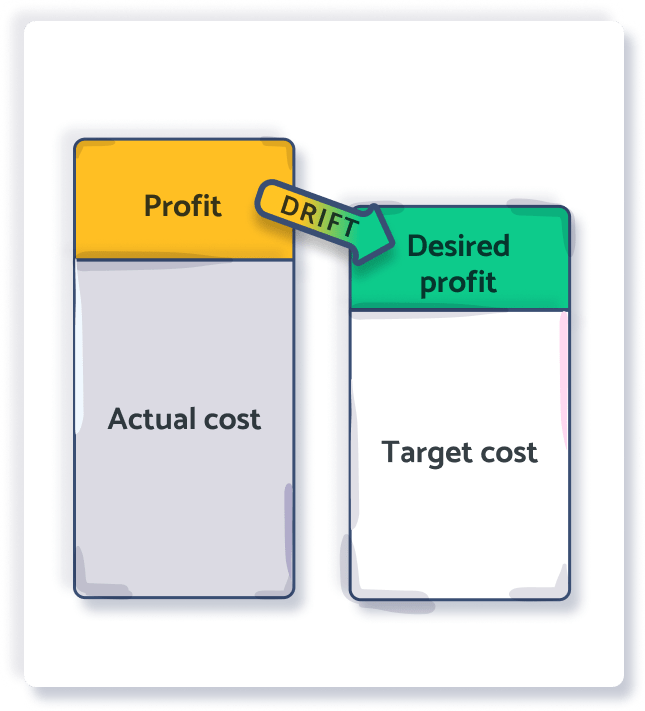

- Calculate Target Price: Subtract the desired profit margin from the expected market price to calculate the target price.

- Validate Against Production Costs: Before finalizing the target price, rigorously evaluate it against the production costs. Ensure that the calculated target price not only covers the cost of manufacturing but also provides a margin for unforeseen expenses. Its at this point a business has a strong basis to assess any inefficiencies within its production and distribution process.

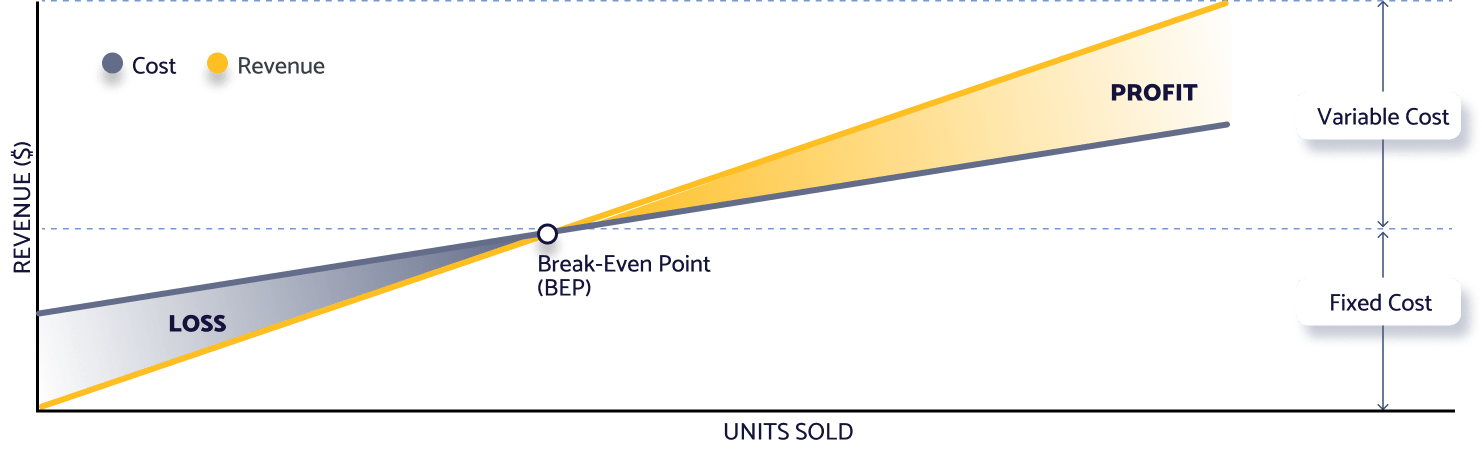

- Calculate Break-Even Point: Determine the break-even point by analyzing the total fixed and variable costs. This step is crucial for understanding how many units need to be sold at the target price to cover all expenses and start generating profit.

- Consider Viability and Adjust as Necessary: Assess the calculated break-even point against the market demand and sales projections. If the break-even point seems achievable and aligns with the expected market demand, the target price is likely viable. If not, consider adjusting the target price or reassessing production costs to enhance viability.

- Iterative Adjustment: Target pricing is not a one-time activity. It requires an iterative approach. Regularly revisit and adjust the pricing strategy based on changing market conditions, production costs, and customer feedback.

Target Pricing: An example

Example: Target Pricing for Innovative Smartwatch

Scenario: A startup is developing an innovative smartwatch and wants to employ target pricing to ensure competitive pricing, customer satisfaction, and financial viability.

Market Analysis:

- Identify competitors’ smartwatches and their prices.

- Understand customer preferences, features in demand, and market trends.

Product positioning Map

Desired Profit Margin:

Set a profit margin of 25% to ensure profitability and cover future R&D costs.

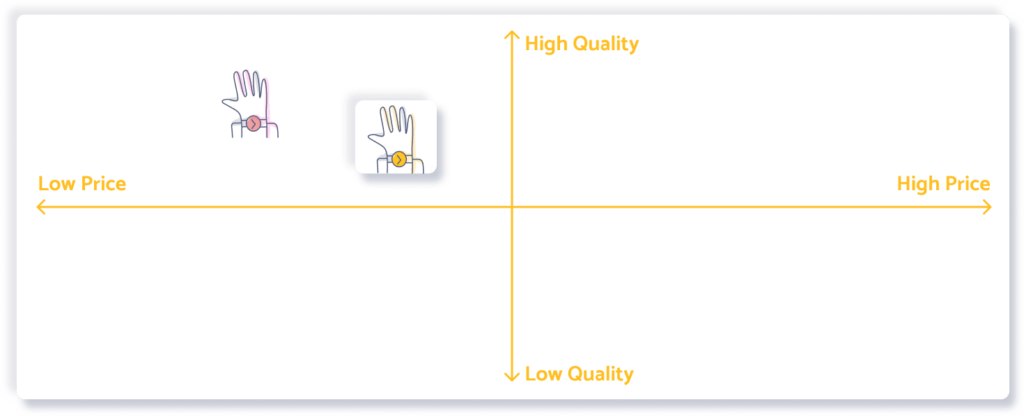

Market Price

Target Price Calculation:

- Competitor Smartwatch Price: $300

- Profit Margin: 25%

- Target Price = $300 – (25% of $300) = $225

Validate Against Production Costs:

- Evaluate production costs, including manufacturing, technology, and distribution.

Market Price Evaluation

- Ensure the target price of $225 covers all costs and provides a reasonable profit margin

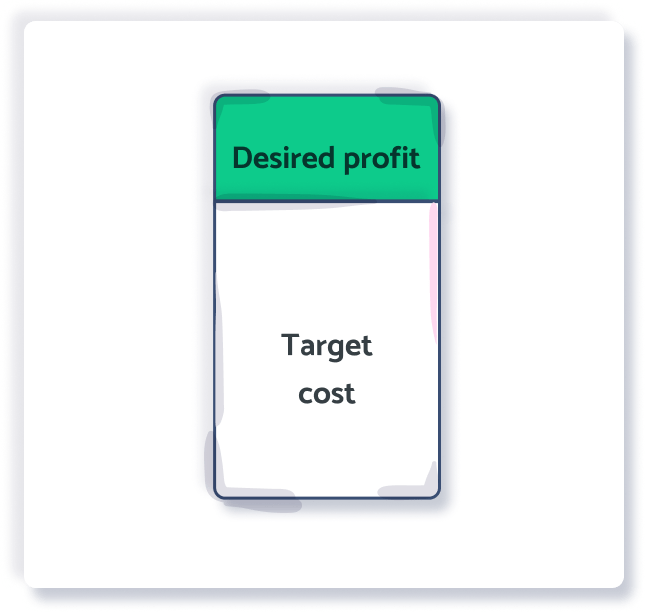

Break-Even Calculation:

- Fixed Costs (Development, Marketing, etc.): $500,000

- Variable Cost per Unit: $100

- Break-Even Units = $500,000 / ($225 – $100) = 5,000 units

Break-Even Analysis

Viability Assessment:

- Hypothetical Scenario: Assume the startup projects an initial market demand of 8,000 smartwatches. Considering this, the break-even point of 5,000 units suggests a viable target price. The anticipated market demand exceeds the break-even point, indicating that even after covering costs, the company expects a healthy sales volume that aligns with its production capabilities.

Market Price Evaluation

Iterative Adjustment:

- Hypothetical Scenario: After the initial product launch, customer feedback suggests a strong preference for an additional feature. The startup decides to enhance the smartwatch by incorporating this feature, leading to a slight increase in production costs. To maintain competitiveness, the company may need to adjust the target price. The iterative adjustment process allows the startup to adapt to evolving market demands and maintain a balance between customer satisfaction and profitability.

These hypothetical scenarios illustrate the practical application of viability assessment and iterative adjustment in the dynamic environment of product development and market reception.

How to Implement Target Pricing:

- Hire the right expert:

Ensure you hire someone experienced as this is an important decision you will make - Ensure Cross functional collaboration:

Ensure collaboration between marketing, finance, and production teams for accurate data analysis and decision-making. - Invest in Market Research:

Regularly conduct market research to stay updated on customer preferences and market trends. - Iterative Approach:

Adopt an iterative approach, continuously adjusting prices based on changing market conditions, customer feedback, and production cost fluctuations. - Validate Against Production Costs:

Before finalizing the target price, rigorously evaluate it against the production costs, including any adjustments due to product enhancements or modifications. - Calculate Break-Even Point:

Determine the break-even point considering any changes in fixed and variable costs due to adjustments in the product features or manufacturing processes. - Consider Viability and Adjust as Necessary:

Assess the break-even point against the updated market demand and sales projections. If the market demand has shifted or production costs have changed, consider adjusting the target price accordingly. The aim is to ensure that the target price remains viable and aligns with both customer expectations and the company’s financial goals. - Iterative Adjustment:

Continue to monitor market dynamics, competitor actions, and customer preferences. Iterate on the target price as needed to maintain a balance between competitiveness, customer satisfaction, and financial viability.

Conclusions

The strategic approach of target pricing emerges as a powerful tool for businesses, providing a customer-centric, competitive, and financially viable method for setting product prices. By carefully navigating the steps outlined in this blog, startups can not only satisfy their customers but also ensure long-term profitability in an ever-evolving market.

About Us

Co-Founders Ashley Law-Smith and Mike Mobilia are the principal advisors. Their extensive assistance has enabled numerous clients to leverage maximum advantages.

Navigating the dynamic landscape of entrepreneurship can be challenging, but with our dedicated advisory services, we’re here to guide you every step of the way. Whether you’re in the early stages of ideation or seeking strategies for sustainable growth, our team of seasoned advisors brings a wealth of knowledge to address your unique challenges.

From crafting solid business plans to optimizing financial strategies, we specialize in providing tailored solutions to catapult your startup towards success.

Explore our comprehensive advisory services and empower your journey from startup to success story.

We invite you to initiate a dialogue regarding how we can support your innovative ventures.

Connect with us for a no-obligation consultation.

SOCIAL MEDIA HANDLES

CONTACT INFORMATION FOR PR:

hello@thestartupnerds.com